Axis My India, a leader in consumer data analytics, presents compelling findings from the latest India Consumer Sentiment Index (CSI) that underscore the dynamic shifts in media consumption patterns across Indian households. The data reveals a nuanced change in media engagement, with a slight increase in families consuming various media forms like TV, Internet, and Radio. In the rapidly evolving digital era, marked by the widespread use of smartphones and affordable internet, there is a noticeable shift towards streaming platforms. 25% of respondents are moving away from traditional cable or satellite subscriptions, embracing the flexibility of digital streaming services. However, traditional media retains its relevance, with 40% of respondents still preferring cable subscriptions, illustrating the coexistence of traditional and digital media formats. The survey further delves into diverse content preferences across different platforms and age groups, highlighting varied interests in serials, movies, sports, and both long and short-form videos.

The January net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +10.3, which is an increase of +0.3 from the last month.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer -Aided Telephonic Interviews and included 4603 participants from 35 states and UTs. Among them, 70% were from rural areas and 30% from urban areas. In terms of regions, 25% were from the North, 27% from the East, 31% from the West, and 17% from the South of India. Among the participants, 59% were male and 41% were female. Looking at the largest groups, 28% were aged between 36 and 50 years old, while 27% were aged between 26 and 35 years old.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "It is clear we're at the dawn of a new era in how content is consumed. The rise of smartphones and accessible internet has ushered in a shift towards streaming platforms, with a significant portion of audiences embracing this new mode of engagement. Yet, importantly, traditional cable remains a steadfast choice for many, suggesting a diverse and multifaceted media landscape. This blend of new and old, from serials to movies, and sports to varied video formats, reveals a rich tapestry of consumer preferences that transcend age groups and traditional norms. Looking ahead, these insights point to a future where media consumption is not about choosing between digital and traditional, but rather about how these mediums can coexist and complement each other.

Axis My India, a leading consumer data intelligence company, reveals the latest insights into shifting media consumption habits in India. The survey highlights a notable 23% families report media consumption, resulting in a 3% increase from last month. Focusing on the ICC World Cup 2023 viewership, the study exposes diverse preferences, with 31% opting for traditional television and a significant 22% choosing the mode of mobile phones. The analysis of daily time allocation on media presents a clear trend toward digital platforms, especially for shorter durations, indicating a dynamic transformation in media consumption patterns. Axis My India's findings offer a comprehensive view of the evolving media landscape, influencing the future of consumer behavior in India.

The December net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9.9, which is an increase of +0.9 from the last month.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 5,143 participants from 35 states and UTs. Among them, 72% were from rural areas and 28% from urban areas. In terms of regions, 23% were from the North, 24% from the East, 28% from the West, and 25% from the South of India. Among the participants, 60% were male and 40% were female. Looking at the largest groups, 30% were aged between 36 and 50 years old, while 25% were aged between 26 and 35 years old

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "As we analyse the recent trends in India's economic landscape, the subtle yet significant transformations in consumer behavior and spending emerges distinctly. The evolving spending habits reveal a fascinating dynamic of necessity versus aspiration in consumer behavior. We are seeing a nuanced evolution in how households manage their finances and what they prioritise. From embracing digital technology to rethinking financial strategies, the Indian consumer is navigating an ever-changing economic environment with adaptability and foresight. The adaptability to govt schemes also highlights the govt’s role in spreading awareness towards their initiatives as an extension of their contribution to the nation. This trend is a reflection of the current economic and political climate, but is also a crucial indicator for the retail industry, signaling shifting consumer priorities and guiding future market strategies"

.png)

Axis My India, a leading consumer data intelligence company, has unveiled the latest insights from the India Consumer Sentiment Index (CSI), shedding light on significant media consumption trends. With the ICC ODI Cricket World Cup 2023 in full throttle and India dominating, overall 67% plan to watch the matches. A whopping 57% are flocking to online mobile streaming platforms such as Hotstar for live action, while 49% is hooked to their Linear Television sets, 8% are watching it on Connected TVs. Oppo, Thums Up, Mahindra, Havells, Dream 11 are the top recalled brands on ICC ODI World Cup. The report also notes that 20% of families are broadening their media horizons, with platforms such as TV, Internet, and Radio. Interestingly, consumption across these platforms remains consistent, showing no change from last month's figures.

The November net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9, which is an increase of +1 from the last 2 months.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 4,980 participants from 35 states and UTs. Among them, 69% were from rural areas and 31% from urban areas. In terms of regions, 23% were from the North, 25% from the East, 28% from the West, and 23% from the South of India. Among the participants, 65% were male and 35% were female. Looking at the largest groups, 34% were aged between 36 and 50 years old, while 27% were aged between 26 and 35 years old

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "As the pulse of the ICC ODI Cricket World Cup 2023 quickens, India's enthusiasm resonates across both fields and screens. While a significant portion of fans eagerly tune in for the critical matches, we are seeing a blend of modern and traditional viewing preferences. Digital platforms are commanding attention, yet the charm of conventional cable/DTH remains unshaken. Interestingly, amidst the cricketing showdown, advertisements continue to play their own game of capturing viewer attention. This amalgamation of viewership patterns and advertising impact offers a compelling insight into a nation deeply invested in the sport, both on and off the pitch."

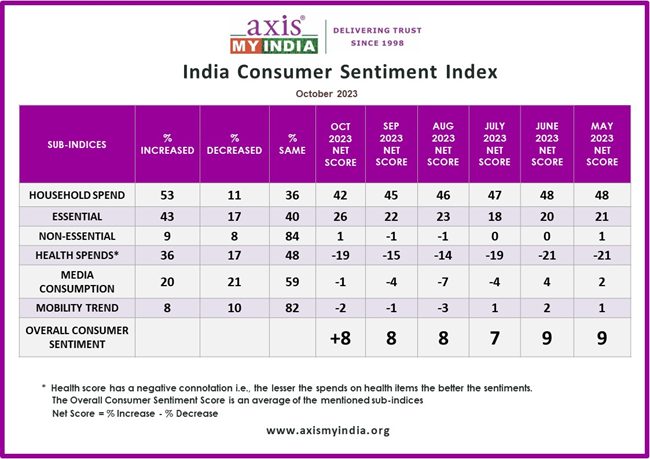

Axis My India, a leading consumer data intelligence company, unveils the latest insights from the India Consumer Sentiment Index (CSI), revealing noteworthy trends in consumer behaviour. The report showcases a diverse range of data, such an increase in overall household spending for 53% of families, highlighting a nuanced 2% dip from the last month. Additionally, the festive spirit seems to be in full swing, as 55% of respondents plan to prioritize spending on festive delights, from food and groceries to clothing and accessories. Significantly, 43% of shoppers spotlight product quality as their foremost consideration, indicating a discerning and quality-conscious consumer base. The report also celebrates the enduring appeal of local markets, with 56% of participants favouring them, echoing the "vocal for local" ethos. With the festive season ushering in renowned sales events and diverse shopping experiences, the findings provide a vibrant and optimistic outlook for businesses and consumers alike.

The October net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, which is the same as compared to last 2 months.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 5452 participants from 35 states and UTs. Among them, 66% were from rural areas and 34% from urban areas. In terms of regions, 32% were from the North, 20% from the East, 39% from the West, and 9% from the South of India. Among the participants, 64% were male and 36% were female. Looking at the largest groups, 29% were aged between 36 and 50 years old, while 28% were aged between 26 and 35 years old.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "As we navigate through this festive season consumers are showcasing a harmonious blend of traditional values and modern preferences. As we enter this festive season, it is evident that quality and local sourcing remain paramount, yet the digital realm is undeniably shaping purchasing decisions. Brands that understand this synergy and can cater to both aspects will undoubtedly thrive. Furthermore, the survey insights reveal an undying commitment to supporting local businesses, echoing the spirit of self-reliance and the 'vocal for local' ethos. The commitment to local vendors and businesses emphasizes a deep-rooted sense of community and reflects a collective effort to foster and support local ecosystems. We see a conscientious shift towards responsible consumerism, where the emphasis is equally on the source as it is on the quality of the purchase. The consumer today is informed, engaged, and values-centric, shaping a transformative era in retail that is rich in trust, quality, digital savviness, and a deeply rooted community spirit."

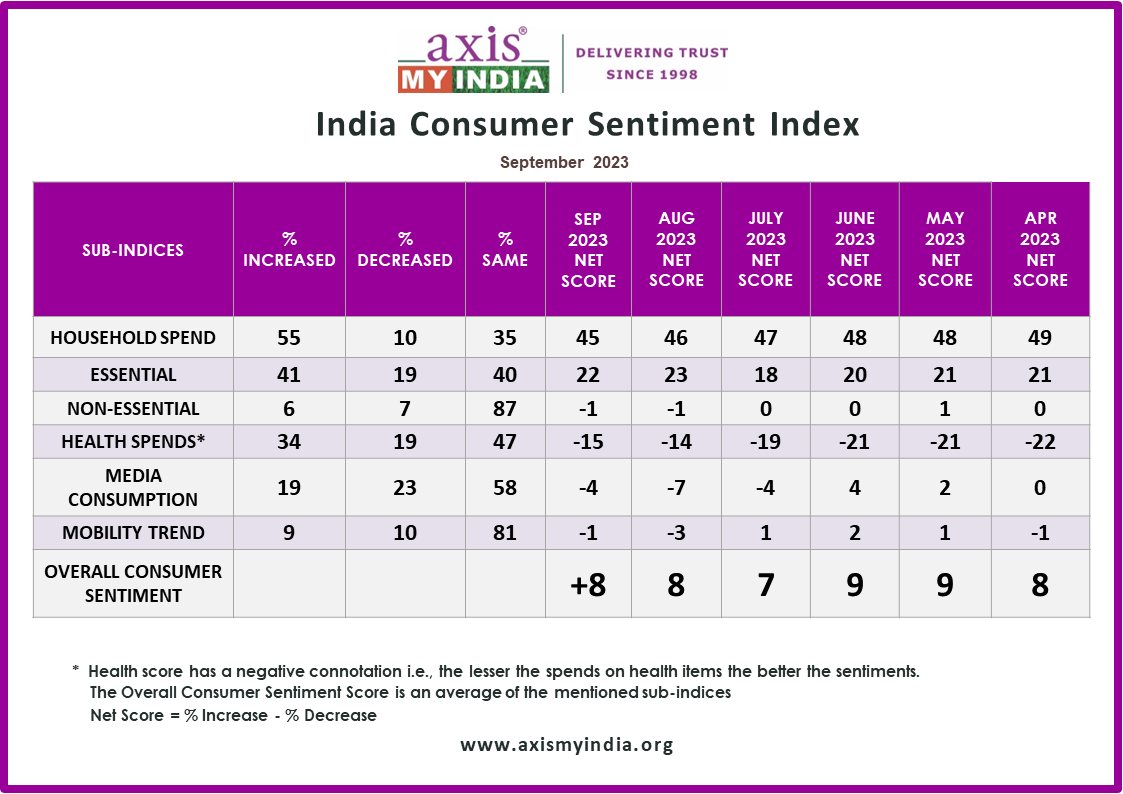

Axis My India, a leading consumer data intelligence company, unveils the latest insights from the India Consumer Sentiment Index (CSI), revealing noteworthy trends in consumer behavior. The report showcases a diverse range of data, such as the 3% decrease in overall household spending for this month compared to the previous month. Notably, 23% of respondents are anticipating increased shopping activities during the upcoming festive season, reflecting a positive sentiment towards holiday spending. Additionally, 44% of those intending to maintain their pattern of participation in e-commerce festive sales this year plan to spend more than last year. These numeric insights provide a quantitative backdrop to the evolving consumer landscape, guiding market strategies for the festive period.

The September net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, which is same as last month (+8). However, the score reflects a dip of -2 from last year September 2022 (+10)

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 5048 participants from 35 states and UTs. Among them, 68% were from rural areas and 32% from urban areas. In terms of regions, 22% were from the North, 24% from the East, 28% from the West, and 26% from the South of India. Among the participants, 62% were male and 38% were female. Looking at the largest groups, 29% were aged between 36 and 50 years old, while 27% were aged between 26 and 35 years old

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "As we approach the festive season, our insights paint an encouraging picture for the retail landscape. A significant number of respondents are ready to elevate their shopping experiences, while others are poised to maintain their spending levels. E-commerce continues to play a pivotal role, with an increasing interest in festive online sales. This evolving trend suggests a promising market dynamic. As consumer preferences shape the retail arena, we anticipate a vibrant festive shopping spree ahead, reflecting a positive and forward-looking trend."

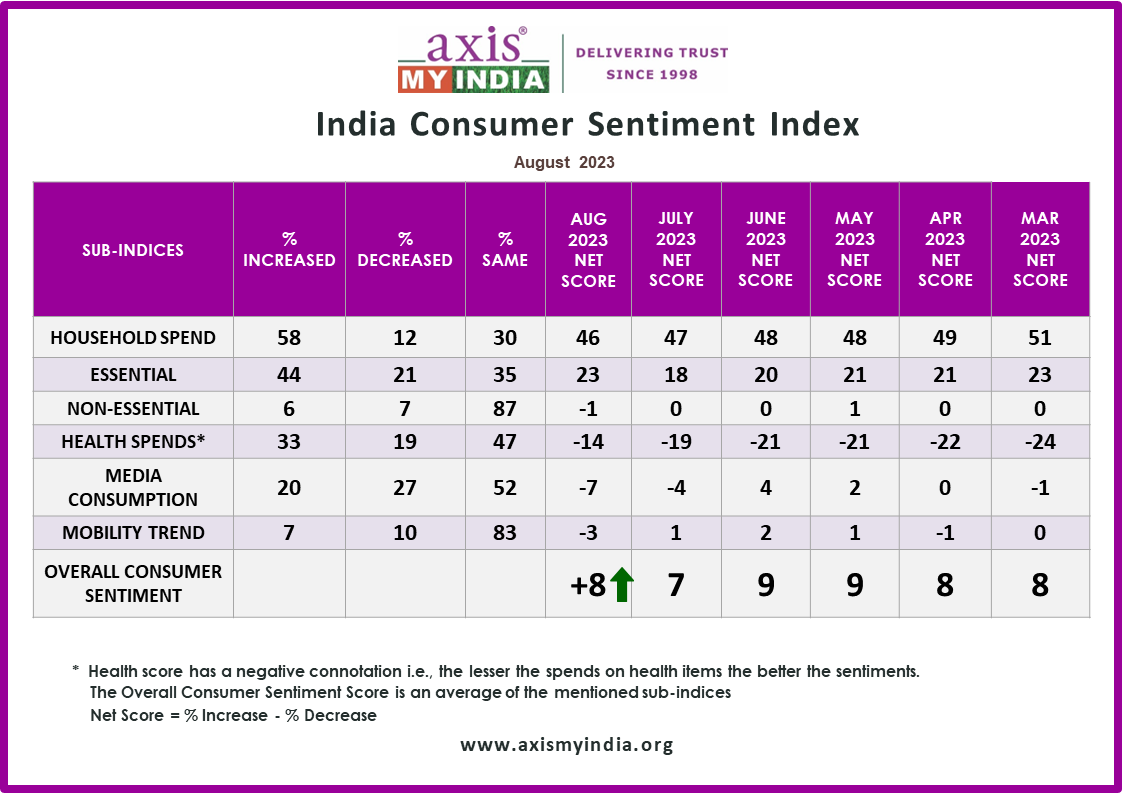

National, 3rd August 2023:, Axis My India, a leading consumer data intelligence company, has unveiled its latest report on the India Consumer Sentiment Index (CSI), providing invaluable insights into evolving media consumption patterns, consumer behaviour, and data privacy sentiments. The survey shows the final balance between Television media consumption and Online Video Content Consumption both dominating as primary mode of entertainment. Moreover, the report reveal trends in movie theatre visits, OTT consumption and Radio consumption. With data-driven observations and comprehensive analysis, this report serves as a crucial resource for businesses seeking to align their marketing strategies with changing consumer preferences in the digital age.: Axis My India, a leading consumer data intelligence company, has unveiled its latest report on the India Consumer Sentiment Index (CSI), providing invaluable insights into evolving media consumption patterns, consumer behaviour, and data privacy sentiments. The survey shows the change in media consumption, particularly among younger demographics, with TV News Channels and Social Media dominating as primary news sources. Moreover, the report reveals intriguing trends in movie theatre visits, online shopping habits, and preferred sources of product information. With data-driven observations and comprehensive analysis, this report serves as a crucial resource for businesses seeking to align their marketing strategies with changing consumer preferences in the digital age. The August net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, which has increased as compared to last month (+7). The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out, via Computer-Aided Telephonic Interviews with a sample size of 5092 people across 35 states and UTs. 65% belonged to rural India, while 35% belonged to urban counterparts. In terms of regional spread, 22% belong to the Northern parts while 25% belong to the Eastern parts of India. Moreover, 28% and 26% belonged to Western and Southern parts of India respectively. 61% of the respondents were male, while 39% were female. In terms of the two majority sample groups, 31% each reflect the age group of 36YO to 50YO and the age group 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said, "The media consumption landscape is continuously evolving, revealing intriguing trends that promise a transformative future for content engagement. Digital platforms are experiencing remarkable growth, driven by tech-savvy youth, while traditional mediums like TV and newspapers retain their allure. Noteworthy is the renaissance of cinema, spearheaded by urbanites and seniors. Looking ahead, digital media's dominance is set to soar further, with online video content and OTT shows captivating millions daily. Yet, radio's enduring relevance endorses its appeal in the digitally-driven era. Businesses must adapt to these evolving preferences, crafting tailored experiences to thrive in the ever-expanding universe of media choices."

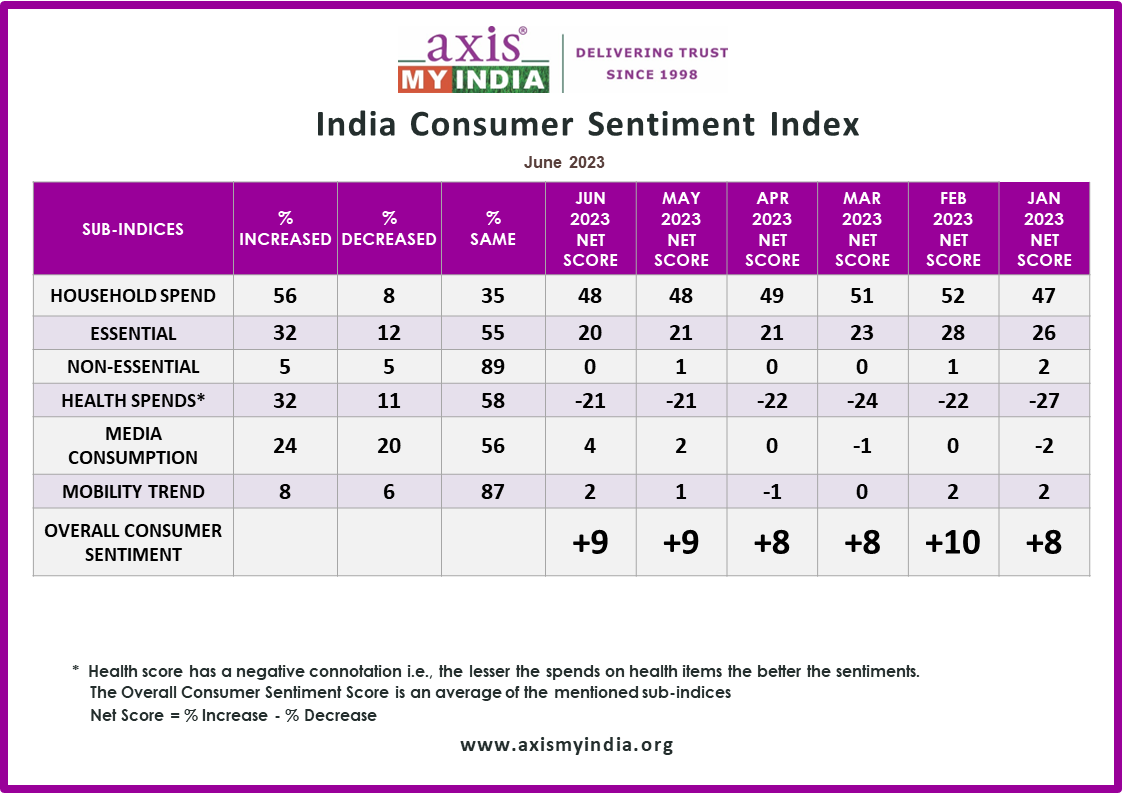

National, 5th July 2023:, Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The June report reveals intriguing insights into the changing spending patterns and consumer behaviour in India. Notably, overall household spending has remained consistent, with a slight increase in Rural as compared to Urban markets. Furthermore, the survey shed light on consumer preferences for summer durable products like air conditioners (AC) and refrigerators and summer products such as ice creams and beverages, revealing a slightly muted summer. These findings provide valuable insights into the evolving market trends and consumer preferences during the summer season.

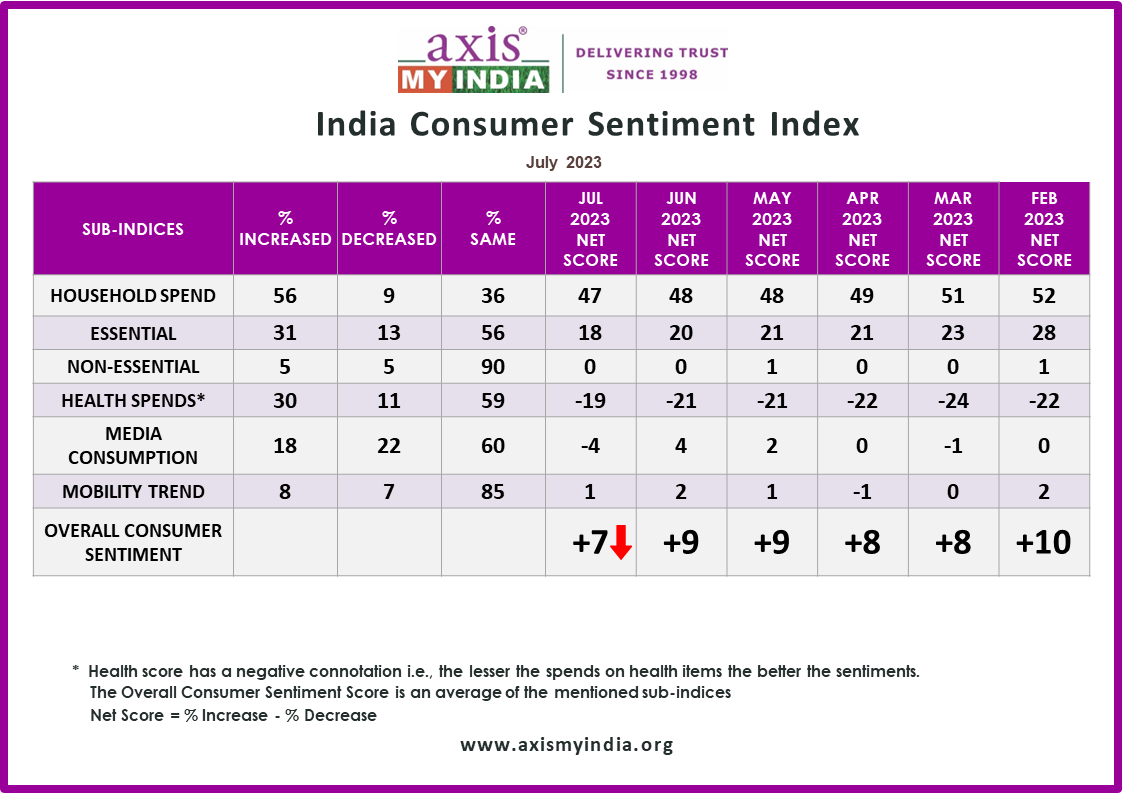

(A&M + Public Issue) National, 06th June 2023: Axis My India, a leading consumer data intelligence company, has unveiled its latest report on the India Consumer Sentiment Index (CSI), providing invaluable insights into evolving media consumption patterns, consumer behaviour, and data privacy sentiments. The survey shows the change in media consumption, particularly among younger demographics, with TV News Channels and Social Media dominating as primary news sources. Moreover, the report reveals intriguing trends in movie theatre visits, online shopping habits, and preferred sources of product information. With data-driven observations and comprehensive analysis, this report serves as a crucial resource for businesses seeking to align their marketing strategies with changing consumer preferences in the digital age. The July net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +7, which has decreased as compared to last month (+9). The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, and entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 5072 people across 35 states and UTs. 67% belonged to rural India, while 33% belonged to urban counterparts. In terms of regional spread, 23% belong to the Northern parts while 22% belong to the Eastern parts of India. Moreover, 26% and 29% belonged to Western and Southern parts of India respectively. 59% of the respondents were male, while 41% were female. In terms of the two majority sample groups, 31% reflect the age group of 36YO to 50YO and 27% reflect the age group 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "Amidst India's ever-changing economic landscape, our comprehensive survey reveals fascinating patterns in media consumption, information seeking, and online shopping habits. Embracing the digital era, the youth drive a surge in digital platform usage, while traditional sources like TV news maintain steadfast relevance. The cinema’s revival is noteworthy, with urbanites and seniors spearheading this trend. Trust remains paramount, as consumers rely on shopkeepers, local markets, and online searches for product insights. However, data privacy concerns loom, particularly among the younger generation. These insightful trends underscore the imperative for a versatile approach to cater to the diverse preferences of our dynamic consumer base."

Summary

(Retail) National, 06th June 2023: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The June report reveals intriguing insights into the changing spending patterns and consumer behaviour in India. Notably, overall household spending has remained consistent, with a slight increase in Rural as compared to Urban markets. Furthermore, the survey shed light on consumer preferences for summer durable products like air conditioners (AC) and refrigerators and summer products such as ice creams and beverages, revealing a slightly muted summer. These findings provide valuable insights into the evolving market trends and consumer preferences during the summer season.

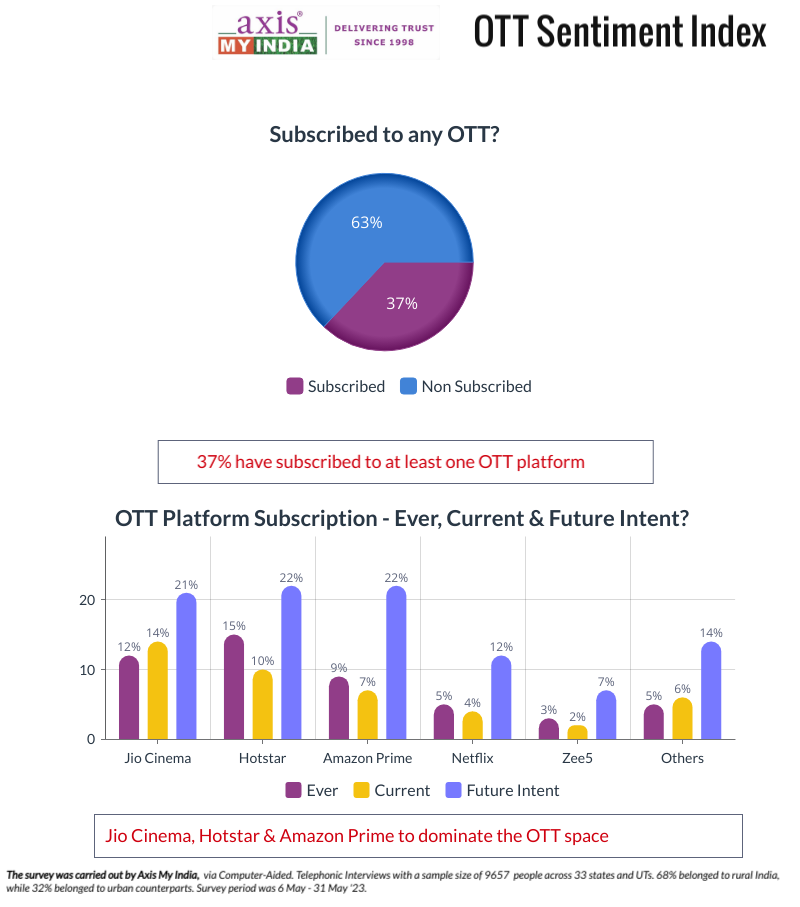

(A&M + Public Issue) National, 06th June 2023 Axis My India, a leading consumer data intelligence company, has released its latest findings of the India Consumer Sentiment Index (CSI), offering valuable insights into the evolving landscape of media consumption and societal attitudes. The report highlights notable trends in media viewership, particularly a significant increase in consumption across various platforms, including TV, Internet, and Radio. Surprisingly, males and the 18-25-year-old age group exhibited the highest growth in media viewership. Additionally, the survey delved into the preferences and subscriptions of Over-The-Top (OTT) platforms, revealing the dominant platforms, such as Hotstar, Jio Cinema, Amazon Prime, and Netflix. The report also shed light on the anticipated viewership of upcoming India vs Australia World Test Championship, with varying levels of interest across TV and digital/mobile platforms. Furthermore, the report unveiled that a significant proportion of respondents showed support for granting equal marriage rights to same-sex couples, reflecting evolving societal attitudes.

(Tech+Economy+HR) National, 06th June 2023 Axis My India, a leading consumer data intelligence company, has released its latest findings of the India Consumer Sentiment Index, shedding light on optimistic consumer perceptions around the economy, employment, and technology adoption. A notable majority has expressed confidence that India will not face an economic recession or just to some extent in 2023, indicating stability for the country's economy. Furthermore, a significant proportion of participants reported being unaffected by job cuts or layoffs which contrasts with some of the global economies. Additionally, the survey highlighted the positive sentiment towards AI-related tools, with respondents acknowledging their ability to reduce workload and save time. These insights signify the growing acceptance and recognition of technology's potential to enhance productivity and efficiency in the workplace. Overall, the survey reflects a prevailing sense of optimism among consumers, with positive sentiments regarding the economy, job stability, and the increasing adoption of AI technologies.

The June net CSI score calculated by percentage increase minus percentage decrease in sentiment, is at +9, which has remained the same as compared to last month.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 9657 people across 33 states and UTs. 68% belonged to rural India, while 32% belonged to urban counterparts. In terms of regional spread, 30% belong to the Northern parts while 27% belong to the Eastern parts of India. Moreover, 30% and 13% belonged to Western and Southern parts of India respectively. 68% of the respondents were male, while 32% were female. In terms of the two majority sample groups, 30% reflect the age group 26YO to 35YO and 31% reflect the age group of 36YO to 50YO.

(Retail) Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "Understanding the shifts in consumer spending patterns is crucial in adapting to the evolving market dynamics. Household spends at an overall level has remained consistent, signifying the stability of the Indian economy. Additionally, the slight rise in essential spends for rural consumers underscores the importance of meeting basic needs by the segment and the sustained demand for non-essential and discretionary products highlights the aspirational mindset of the 26-35 age group. The insights from our survey shed light on the cautious approach towards summer season categories, with a significant majority opting to delay their purchase. These shifts in consumer behavior reflect evolving aspirations, changing priorities, and the need for businesses to adapt and cater to their evolving needs."

(A&M + Public Issue) Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "We have witnessed a significant shift in the preferences and usage patterns of OTT platforms among Indian consumers. The dominance of Jio Cinema and Hotstar as the top two currently subscribed platforms reflects the widespread availability and appeal of these services. The growing popularity of Amazon Prime and the consistent presence of Netflix demonstrate the increasing demand for diverse content offerings. It is intriguing to note the dynamic nature of platform preferences, with Jio Cinema surpassing others as the most widely used platform mainly on the back of IPL. This indicates the evolving landscape of consumer choices and the need for platforms to continuously innovate and cater to changing preferences. As consumers seek more personalized and engaging content experiences, platforms must continue to invest in captivating offerings to retain and attract subscribers. Our study also sheds light on the viewership preferences for the upcoming India vs Australia World Test Championship, highlighting a balanced interest in both traditional TV viewing and digital/mobile platforms. This emphasizes the importance of multi-platform strategies for broadcasting major sporting events to cater to the diverse preferences of consumers."

(Tech+Economy+HR) Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "The survey underlines positive sentiment among consumers regarding the future of technology, the economy, and the job market. Our findings showcase a slow but growing acceptance and utilization of AI-related tools, offering opportunities to streamline workflows and boost productivity. As we embrace the advancements in technology, businesses can leverage this momentum to foster innovation, create job opportunities, and contribute to the overall economic growth of the country."

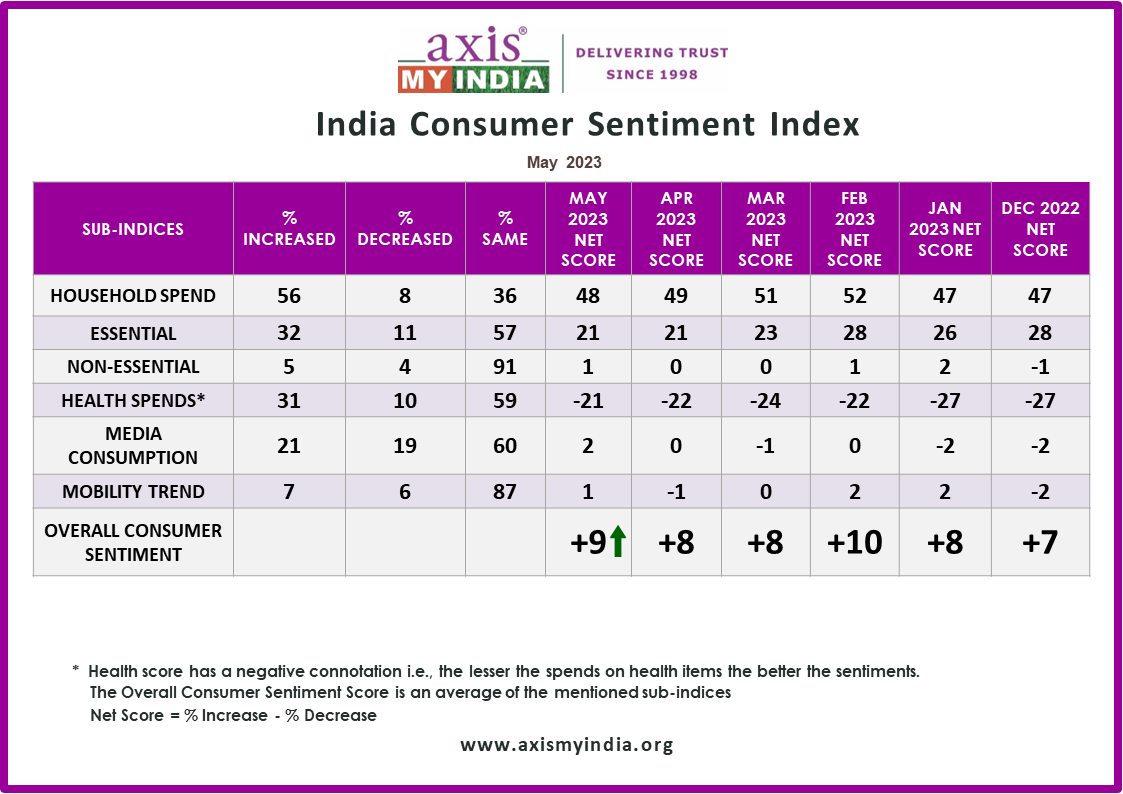

National, 3rd May 2023: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The May report highlights that media viewership has increased for a significant proportion of households, with males and younger age groups displaying higher consumption rates. With the IPL fever gripping the nation, the survey shows that cable/DTH television sets are the favoured mode of watching for the middle-aged population, while the younger demographic prefers mobile (Jio Cinema). The report also highlights the top brands that captured viewers' attention, with Dream11 & Thums Up securing the highest recall among viewers.he May net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +09, which has increased by 1 point compared to last month.

The sentiment analysis: delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 10,206 people across 35 states and UTs. 64% belonged to rural India, while 36% belonged to urban counterparts. In terms of regional spread, 26% belong to the Northern parts while 25% belong to the Eastern parts of India. Moreover, 29% and 19% belonged to Western and Southern parts of India respectively. 64% of the respondents were male, while 36% were female. In terms of the two majority sample groups, 32% reflect the age group 36YO to 50YO and 29% reflect the age group of 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "Today's media landscape is evolving at a rapid pace, and our survey results highlight some intriguing trends that businesses and marketers should take note of. From a growing appetite for environmentally conscious products among young consumers, to the increasing popularity of mobile viewing during events like the IPL, to the rising interest in AI tools like ChatGPT, there are plenty of insights here for stakeholders across a range of industries. By paying attention to these shifts in consumer behavior, businesses can position themselves for success in the months and years ahead."

May.jpg)

(Retail + General Interest + HR) National, 3rd April 2023: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The April report reveals that household spending has increased for a majority of families in the country with Andhra Pradesh and Telangana leading the way. While essential spends increased more for rural segments, non-essential/discretionary spends remained the same as last month. However, with the summer season approaching, a surge in interest in buying white goods in the next few months is expected. The survey also revealed that product quality and brand name are key factors influencing product purchase decisions, with celebrities featuring in advertisements also influencing buying decisions to some extent. The enthusiasm for IPL is expected to increase further, with both TV & mobile contributing to viewership.

(A&M) National, 3rdApril 2023: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The April report highlights that 19% of families have reported a rise in media consumption. Moreover, the survey reveals that urban areas and male viewers are leading the surge in media viewership. The enthusiasm for IPL is expected to increase further, with both TV & mobile contributing to viewership. The study also delved into the key factors that influence consumers' buying decisions, revealing that product quality and brand name remain important considerations. Additionally, the survey sheds light on the role of celebrity endorsements in driving product purchases, with younger age groups being more susceptible to their influence.

The April net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, which is the same as last month. The corresponding net score last year was +11. The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 10,034 people across 33 states and UTs. 66% belonged to rural India, while 34% belonged to urban counterparts. In terms of regional spread, 25% belong to the Northern parts while 26% belong to the Eastern parts of India. Moreover, 28% and 21% belonged to Western and Southern parts of India respectively. 63% of the respondents were male, while 37% were female. In terms of the two majority sample groups,29% reflect the age group 36YO to 50YO and 29% reflect the age group of 26YO to 35YO.

(Retail, General Interest + HR) Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said “Despite a dip in consumer sentiment last year, the upcoming summer season is expected to see an increase in purchases of white goods such as air conditioners and refrigerators. However, there is still an overall sense of restraint or reduction in sentiment across indices. On a positive note, the younger generation shows promise as per the survey findings, with a slight increase in mobility suggesting a more outgoing nature. Furthermore, with more job opportunities available, this segment remains optimistic about their future. Additionally, with 30% of youngsters planning domestic holidays, there is potential for an increase in travel-related sales. These insights provide valuable information for marketers to strategize their efforts by focusing on consumer needs and preferences."

(A&M) Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "Closely examining the findings of our latest survey, it is clear that media consumption habits are not uniform across demographics, with variations emerging among different age and gender groups. It is noteworthy that younger age groups are showing a greater appetite for media consumption, with a particular interest in watching the Indian Premier League. Digital is expected to contribute significantly to the rise of IPL viewership. As we delve deeper into consumer behaviour, it is evident that product quality and brand name remain key considerations, but we are also seeing a significant impact of celebrity endorsements on purchasing decisions, especially among younger age groups. These insights highlight the need for brands to stay attuned to the evolving consumer preferences and tailor their marketing strategies accordingly to drive engagement and enhance customer loyalty."

.png)

Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The survey further highlighted that sentiments have dipped across 4 out of 5 sub-indices, importantly, sentiments have slightly dropped towards essential and non-essential spends. However, the March report reveals that consumer outlook are positive towards the 2023 Budget announcement presented by Finance Minister Nirmala Sitharaman and overall, the Indian consumer sentiment is optimistic that the country's economy will continue to grow at an accelerated rate in 2023, owing to the country's robust fight against all obstacles in the previous year. 72% think PM Narendra Modi is India’s most influential person and Covid management, infrastructure development, and welfare schemes were the key achievements of the BJP government.

The March net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +8, from +10 last month reflecting a decrease by 2 points.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 10124 people across 36 states and UTs. 65% belonged to rural India, while 35% belonged to urban counterparts. In terms of regional spread, 26% belong to the Northern parts while 30% belong to the Eastern parts of India. Moreover, 24% and 20% belonged to Western and Southern parts of India respectively. 67% of the respondents were male, while 33% were female. In terms of the two majority sample groups, 31% reflect the age group 36YO to 50YO

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said "The Indian Budget 2023 focused on reviving the economy, which was impacted by the COVID-19 pandemic and various other obstacles. The government announced various measures for citizens’ financial empowerment and improved standard of living. This was highly appreciated across the country. PM Modi being rated as the most influential person in India by far is no surprise. At an overall level, while consumer sentiments are subdued, it is expected to revive soon, driven by various factors such as improving economic conditions, growing consumer confidence, and changing consumer behavior. Moreover increasing adoption of e-commerce and digital payments, is likely to drive consumer spending in the near future."

.png)

Mumbai, 30th January 2023: Axis My India, a leading consumer data intelligence company, released its latest findings of the India Consumer Sentiment Index (CSI), a monthly analysis of consumer perception on a wide range of issues. The pre-budget report highlighted that reduction in price of essentials is the biggest expectation from the 2023 budget. One of the major requests which comes out in this survey is reduction in income tax rates, which will give consumers more money in hand.

The Pre-Budget net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +10, from +08 last month reflecting an increase by 02 points.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, entertainment & tourism trends.

The survey was carried out via Computer-Aided Telephonic Interviews with a sample size of 6100 people across 27 states and UTs. 65% belonged to rural India, while 35% belonged to urban counterparts. In terms of regional spread, 23% belong to the Northern parts while 27% belong to the Eastern parts of India. Moreover, 28% and 22% belonged to Western and Southern parts of India respectively. 69% of the respondents were male, while 31% were female. In terms of the two majority sample groups, 33% reflect the age group 36YO to 50YO and 30% reflect the age group of 26YO to 35YO.

Commenting on the CSI report, Pradeep Gupta, Chairman & MD, Axis My India, said “Consumers are looking forward to the upcoming budget announcements as a ray of hope for better life and livelihood and there is a huge expectation in terms of price control. Consumers are also looking forward towards various measures that the government will take towards fuelling digitization in the Indian economy. Overall, despite global headwinds the Indian economy should be poised for further growth in 2023”.

Factors which will significantly impact the Indian economy this year?

| Option | Percentage (%) |

|---|---|

| Oil prices | 22 |

| Inflation | 16 |

| Upcoming 2024 elections | 16 |

| Government policies | 14 |

| Russia-Ukraine war | 11 |

| Unemployment | 5 |

| Impact of other global economies like US, Europe, Japan | 3 |

| Covid-19 | 2 |

| Other | 5 |

Expectations from the upcoming budget?

| Option | Percentage (%) |

|---|---|

| Reduction in prices of essential items like Soap, Detergent, Cooking Oil | 73 |

| GST exemption on essential items | 54 |

| Reduction in GST % | 44 |

| Relook housing loan interest repayment exemption | 32 |

| Lower personal Income Tax rates & surcharge reductions | 28 |

| Longer tax breaks & sops for start ups | 27 |

| Reduction in prices of discretionary/luxury items like Mobile Phone, Automobiles, Jewellery | 21 |

| Lower corporate tax | 8 |

| Change in long term capital gains tax exemption | 7 |

| Increase in the limit for deductions available under section 80 | 4 |

Need to re-look at personal income tax rates in the coming Budget?

| Option | Percentage (%) |

|---|---|

| Yes, reduction by 5% | 26 |

| Yes, the exemption limit should be raised beyond 2.5 lacs | 25 |

| Yes, bring back the standard deduction | 16 |

| Exemption by 30% across all slabs | 2 |

| Exemption by 1-3 lacs across all slabs | 1 |

| No | 11 |

| Don’t know/Can't Say | 13 |

© 2024 Axis My India Ltd All Rights Reserved